Donald Trump’s business journey from New York real estate developer to global brand is marked by ambitious international ventures. His portfolio includes iconic properties and golf resorts in places like Scotland, Ireland, and Dubai. These cross-border dealings offer a clear lesson for any global entrepreneur: successfully managing Trump international real estate demands sophisticated transnational banking solutions, making offshore bank account opening a necessity.

Table of Contents,

🌎 The Geography of Trump International Real Estate and Global Banking Needs

The scope of Trump international real estate holdings is vast, spanning multiple continents and legal jurisdictions.

- Scotland and Ireland: Trump owns prestigious golf resorts like the Trump Turnberry in Scotland and Trump International Golf Links & Hotel in Doonbeg, Ireland. These properties generate revenue, incur operational costs, and require capital investment in local currencies (Pounds and Euros).

- Dubai and Asia: Licensing deals and luxury properties in the Middle East and elsewhere involve large, complex financial flows that must be managed in stable international currencies (like USD, Euro, or AED).

For each of these assets, simply relying on a single U.S. bank account is inefficient and often impractical. This is where an offshore bank account opening strategy becomes crucial for effective foreign asset management.

🏦 The Imperative of Offshore Bank Account Setup for Global Tycoons

For a global tycoon, offshore banking services are not a luxury—they are a core operational tool. An offshore bank account opening provides several immediate and powerful benefits vital to managing the Trump international real estate portfolio:

1. Currency Management and Efficiency

International transactions involve currency conversion. By maintaining accounts in the local currencies of operation (GBP for Scotland, EUR for Ireland), businesses can:

- Minimize foreign exchange transaction costs and fees.

- Hedge against sudden currency fluctuations, protecting profits and capital.

2. Operational Speed and Accessibility

When dealing with urgent payroll, supplier payments, or local tax liabilities in the UAE or Europe, using a local or international bank allows for immediate fund transfers. This efficiency is critical for foreign asset management and day-to-day operations in the competitive luxury hospitality sector.

3. Legal and Regulatory Compliance

Offshore bank account opening enables a global entrepreneur to compartmentalize finances according to regulatory standards in each country. While required to disclose foreign holdings to agencies like the IRS (https://www.irs.gov/vi/about-irs) and comply with international transparency efforts spearheaded by the OECD (https://www.oecd.org/en.html), an offshore account simplifies the process of receiving and documenting foreign-sourced income.

💼 The Role of Transnational Banking in Effective Foreign Asset Management

The strategic use of corporate vehicles—often established through company formation services—coupled with tailored banking solutions, is the bedrock of successful foreign asset management.

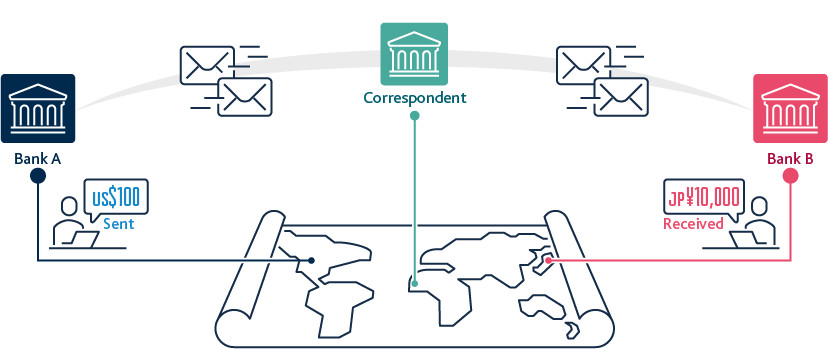

For a business to receive payments from a Scottish hotel or pay utility bills in Dubai, a seamless financial channel is required. This often means the entity owning the property needs a dedicated bank account capable of handling multi-currency transactions. Resources specializing in global account opening are instrumental in navigating these complex, multi-jurisdictional banking requirements.

Ultimately, the need for an offshore bank account opening is directly proportional to the size and complexity of a global real estate portfolio like that of Donald Trump. It is the vital mechanism that translates international brand presence into operational reality.